Market Efficiency Ratios Explained: A Deep Dive into Beta and CAPM

In modern financial markets, investors continuously seek tools that help evaluate risk, return, and market efficiency. Among the most widely used measures are Beta and the Capital Asset Pricing Model (CAPM). Together, they help investors understand how securities respond to market movements and whether expected returns adequately compensate for risk.

Are your investments compensating you enough for the risks you’re taking?

True market efficiency reflects risk and reward in perfect harmony. Beta and CAPM give you the tools to navigate, evaluate, and invest with confidence.

Understanding Market Efficiency

Market efficiency refers to the extent to which asset prices reflect all available information. In an efficient market:

- Security prices adjust quickly to new information

- Assets are fairly valued

- Consistent abnormal returns are difficult to achieve

Market efficiency ratios and models play a crucial role in evaluating whether risk and return are appropriately priced in the market.

What Are Market Efficiency Ratios?

Market efficiency ratios are financial metrics that assess how well market prices reflect underlying risk and expected returns. These ratios focus on:

- Systematic risk exposure

- Market responsiveness

- Risk-adjusted performance

Beta and CAPM are foundational tools used to analyze market efficiency from a risk-return perspective.

Beta: Measuring Systematic Risk

What Is Beta?

Beta (β) measures the sensitivity of a stock or portfolio’s returns relative to overall market movements. It indicates how much an asset’s price is expected to change when the market changes.

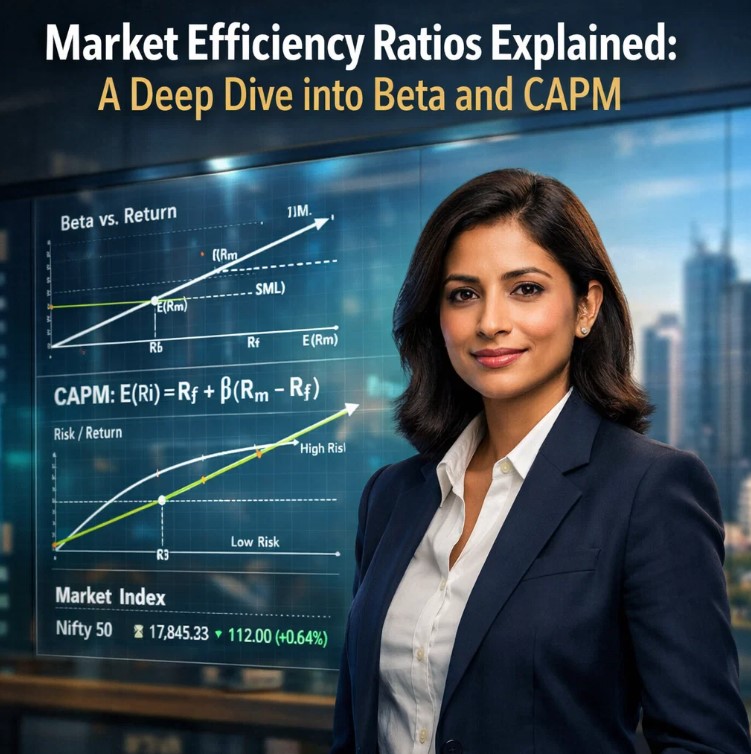

Beta Formula

Beta = Covariance (Asset, Market) ÷ Variance (Market)

Interpreting Beta Values

- β = 1 → Asset moves in line with the market

- β > 1 → Asset is more volatile than the market

- β < 1 → Asset is less volatile than the market

- β = 0 → No correlation with market movements

- β < 0 → Asset moves opposite to the market

For example, a stock with a beta of 1.3 is expected to rise or fall 30% more than the market, while a stock with a beta of 0.7 is considered defensive.

Why Beta Matters for Market Efficiency

Beta captures systematic risk, which cannot be eliminated through diversification. In an efficient market, higher beta should be rewarded with higher expected returns.

Capital Asset Pricing Model (CAPM)

What Is CAPM?

The Capital Asset Pricing Model (CAPM) estimates the expected return of an asset based on its risk relative to the market. It links risk-free returns, market risk premium, and beta.

CAPM Formula

Expected Return = Rf + β (Rm − Rf)

Where:

- Rf = Risk-free rate

- Rm = Expected market return

- β = Beta of the asset

CAPM and Market Efficiency

CAPM operates on the assumption that markets are efficient and investors are rational. Under CAPM:

- Securities are priced along the Security Market Line (SML)

- Higher risk demands higher expected return

- Mispriced assets present temporary arbitrage opportunities

If an asset’s actual return exceeds its CAPM-based expected return, it may be undervalued. If it falls below the expected return, it may be overvalued.

Applications of Beta and CAPM

- Portfolio Construction: Helps balance risk across investments

- Cost of Equity: Used in valuation and WACC calculations

- Performance Evaluation: Compares actual vs expected returns

- Capital Budgeting: Assesses project risk-adjusted feasibility

Limitations of Beta and CAPM

Limitations of Beta

- Based on historical data

- Ignores company-specific risk

- Beta values change over time

Limitations of CAPM

- Assumes a single-factor risk model

- Relies heavily on market efficiency assumptions

- Risk-free rate and market return are estimates

Due to these limitations, investors often combine CAPM with multi-factor models and qualitative analysis.

Beta, CAPM, and Modern Financial Markets

Despite evolving market dynamics and advanced analytics, Beta and CAPM remain cornerstones of financial theory. They continue to serve as baseline models for valuation, portfolio management, and risk assessment.

Conclusion

Market efficiency ratios such as Beta and CAPM offer valuable insights into the relationship between risk and return. While not perfect, they provide a structured framework for understanding how markets price risk and reward investors accordingly.

Mastering these concepts enables investors and analysts to make disciplined, informed, and risk-aware investment decisions in an increasingly complex financial environment.