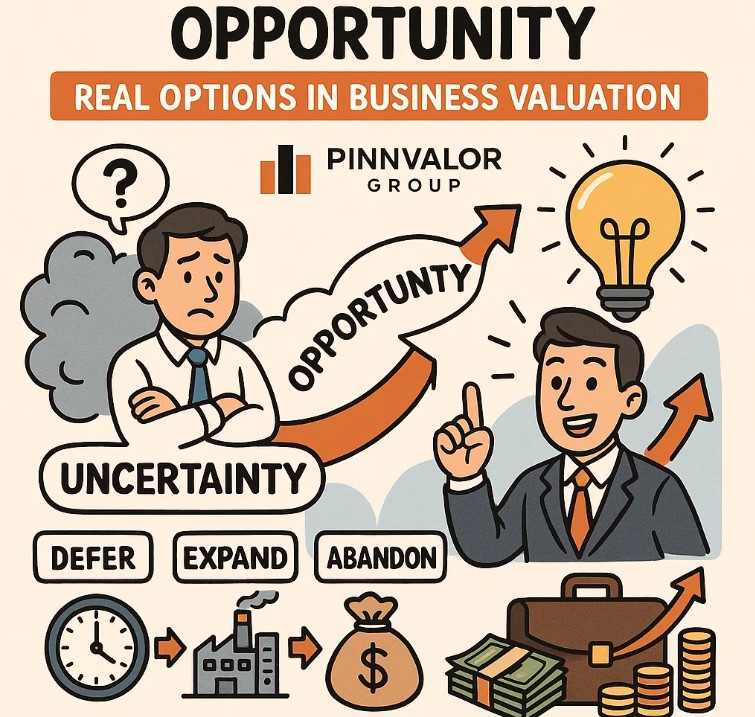

Turning Uncertainty into Opportunity: Real Options in Business Valuation

In today’s fast-changing business environment, uncertainty is the only certainty. Market dynamics, regulatory changes, technological disruptions, and shifting customer preferences all add layers of unpredictability to business decisions. Traditional valuation methods, such as Discounted Cash Flow (DCF) or Net Present Value (NPV), often fail to capture the value of managerial flexibility in uncertain conditions. This is where Real Options come into play.

Real Options provide a framework for valuing choices—such as expanding, delaying, abandoning, or altering a project—giving businesses the ability to turn uncertainty into opportunity.

What if uncertainty wasn’t a risk, but the biggest opportunity in business valuation?

Flexibility is the new currency of business success. Real Options capture the worth of adaptability in uncertain times.

What Are Real Options?

At its core, a real option is the right, but not the obligation, to take a certain business decision in the future based on how events unfold. Unlike financial options, which are contracts traded in markets, real options relate to real-life strategic decisions about business investments.

Examples:

- A pharmaceutical company investing in drug research has the option to expand production if the drug succeeds.

- A tech startup has the option to delay product launch until market conditions improve.

- An infrastructure company has the option to abandon a project if regulatory risks escalate.

Why Traditional Valuation Falls Short

Methods like DCF assume a linear projection of cash flows and discount them at a given rate. While useful, they do not account for:

- The ability to respond flexibly to future uncertainties.

- The strategic value of waiting or altering plans.

- The possibility of capturing upside opportunities while limiting downside risk.

As a result, projects that may appear unattractive using NPV could actually hold significant hidden value when analyzed through the lens of real options.

Types of Real Options in Business

1. Option to Expand

Businesses can scale up operations if initial success is achieved. Example: A retailer opening one pilot store before rolling out nationwide.

2. Option to Delay (Timing Option)

Firms can postpone investment until market conditions are favorable. Example: A renewable energy company waiting for government subsidies before investing in large-scale projects.

3. Option to Abandon

If circumstances worsen, businesses can minimize losses by halting projects. Example: A construction firm stopping a project mid-way due to unviable costs.

4. Option to Switch

Companies can switch between inputs, products, or markets. Example: A manufacturing company switching raw material suppliers depending on price fluctuations.

Real-World Applications

- Oil & Gas Industry: Companies invest in exploration projects with the option to expand drilling if initial results are promising.

- Technology Firms: Startups often treat R&D as a real option—if prototypes succeed, they scale up; if not, they pivot.

- Pharmaceuticals: Drug development is inherently uncertain. The option to proceed after clinical trials represents immense value.

- Infrastructure & Utilities: Long-term projects incorporate abandonment and delay options to mitigate risks.

Advantages of Using Real Options

- Captures the value of flexibility and adaptability.

- Recognizes that uncertainty can create strategic opportunities, not just risks.

- Provides a more realistic valuation framework for dynamic industries.

- Helps managers align investment decisions with long-term strategy.

Challenges in Real Options Valuation

- Complex to model and requires advanced financial techniques (e.g., binomial trees, Black-Scholes model adaptations).

- Heavy reliance on assumptions about volatility, probabilities, and future market conditions.

- Often underutilized due to lack of familiarity among managers and investors.

Conclusion

In the modern business landscape, uncertainty should not be seen purely as a threat. Real Options transform uncertainty into a source of value, giving businesses the flexibility to adapt, grow, and pivot when necessary. By incorporating real options into business valuation, companies can make smarter strategic decisions, better manage risks, and seize opportunities that traditional valuation methods might overlook.

In short: Real options don’t just value a project—they value flexibility, foresight, and strategic vision.